Small payments will have big impact

The web (still) has no widely-used native business model. Whilst there are almost unlimited ways for people to create value online, to this day there remains no widespread, web-native way of transferring money in return. Ecommerce has solved this challenge for many users and purchases, but a whole class of transactions remains unresolved: micropayments (typically defined as a few dollars or less). The impact of this deficiency should not be underestimated.

This paper explores the history, status and promise for micropayments. Further, it aims to show you that micropayments are now poised to impact the web (and the world) as we know it.

Why does this matter to you now?

No matter what kind of organisation you run or work for, it’s likely that micropayments will impact the way you and your customers think about your digital relationships. So why should you pay attention?

- It’s starting to happen – the chances are increasing that you’re missing revenue here and now from visitors that would use micropayments if you supported them

- To stay ahead in the learning curve in this fast changing space

- Provide easier ways for your customers to pay – with either one click or even with none

- Reach more customers than those who are able to pay through PayPal, Mastercard, Visa or bank transfers

- Receive payments without reliance on centralised infrastructure and without having to collect data about your customers

- Reimagine your content as a product in its own right, not just part of a conversion funnel. Optimisation for a micropayment world has lots of side benefits now.

- Revenue diversification – micropayments can be complementary to existing revenue streams

Why does this matter to us?

As a premier WordPress agency, the health of the open web is of critical importance to Angry Creative. Whilst we definitely recognise that a diverse web, including proprietary platforms and walled gardens is both inevitable and healthy, we will always fight the corner of open standards and protocols that empower responsible freedoms.

Having a baked-in business model is one area in which platforms like Medium, Twitter, Facebook and Slate currently have an edge over the open web. In acknowledging this powerful advantage, we are always watching for the opportunity to bring a native business model to WordPress and beyond.

This tweet triggered me to find out more about why this was true, become interested in micropayments and ultimately to write this guide:

The arguments for micropayments

What are the factors that make micropayments so compelling?

- In an age of influencers and social media, the ability to earn money online has become a burning issue for content owners who see their content repackaged and shared on platforms that don’t reward them for their creativity, or who have a large audience but are struggling to monetise that asset.

- Usage rights, metadata and reimbursements are a mess with creators missing out on revenue opportunities. This is not limited to new media – PRS writes off ‘vast sums’ of royalties that could otherwise be claimed by artists because of poor rights attribution.

- The current dominant business model on the web is advertising. Advertising comes with many benefits, including free and open access to information for everyone. However, the underlying business practices of engagement, data and targeting have become increasingly toxic for all involved – to the point at which democracy itself seems at risk

- Computer games that use a Freemium (free-to-play + in-game purchases) model have proven more profitable than paid games. It’s worth noting that some of these in-game purchases are larger than ‘micro’ payments and that a ‘Paymium’ model is emerging, where both up-front and in-game purchases are required to unlock all features. It’s worth noting that this is definitely not universally agreed as a good thing, even by the game developers/publishers who use it – something we’ll discuss in more depth later.

Near-term future reasons include:

- The shortening creation and consumption cycle times (particularly for augmented or virtual reality media) require usage rights and payments to be negotiated in new, faster, and more automated ways

- The need to find more sustainable (economic) ways in which to dis-incentivise bad behaviour online. For example spam, fake reviews, social media trolling, DDOS attacks, or one-sided exploitation of user data.

- Internet of Things devices driving an increase in the number of machines that need to participate in the global economy, either on their own behalf or that of people or broader systems

- The increasing sophistication of AI and their potential to make transactions on our behalf

The limitations of current online payments

Why do current payment systems or business models fail to successfully address the micropayments opportunity?

The combination of money and technology almost inevitably ends up with disruption, as we’ve seen with everything from PayPal and Venmo through to challenger banks like Monzo and Starling in the UK, and the vast WeChat app platform in China. But the dominant ways of transacting online are still limiting in non-trivial ways. Firstly, one needs an account with a third party institution both to make and receive payments in fiat currencies, be that a bank, mobile phone provider or payment processor like PayPal. According to the World Bank, around one third of the world’s population remains unbanked.

“Fiat money is a currency without intrinsic value that has been established as money, often by government regulation”

Wikipedia

Then there is the high cognitive load. For example, paywalls are onerous and even without the multiple steps of ecommerce: cart, check-out, redirection back to where you were, the potential purchaser must mentally evaluate the perceived value of a transaction. That’s fine and proper for many purchases, like a pair of shoes, but what would you pay on a one-off basis to skip YouTube ads? How much per play of an individual song on Spotify? Even spending the time thinking about whether it should be a cent or a nickel seems more value than the transaction itself, even if such a micropayment were possible.

To remedy this, content creators typically expand the size of the content offer to make a more significant payment worthwhile. For example, ‘subscribe monthly for unlimited content’, ‘buy this high value research’, or ‘buy this physical/digital product bundle’. The reality is that the value of a single read of a single piece of content is often measured in cents or fractions of a cent. Or for users who have a subscription but don’t access any content that month, it’s zero value return for a fixed overhead which is unattractive to subscribers.

Most content creator communities therefore rely on free or marginally-recompensed contributions and blunt instrument business models, like lead generation or advertising to generate revenue. Many are propped up by venture capital or private equity money waiting to find a way to monetise.

Meanwhile, most contributor content ends up on social networks that don’t pay anything to the contributors whose content generates their ad revenue. And yet the sheer convenience of ‘one click’ authentication means that the web is increasingly dominated by centralised giants, the likes of Facebook, Amazon, Google, and Apple. The risks to society and individuals from the ‘engagement business model’ run by such platforms, and the power of the data and AI they have at their disposal, are only becoming clearer daily. These giants profit greatly from this business model, but one must question its sustainability.

This issue was highlighted in an article in Wired earlier this year, where the author observed that “Even the apparent winners of the digital ad economy—Facebook and YouTube—must operate at vast scale, engage in copious surveillance, and subject their systems to minimal human oversight to make ad financing work.”

“Even the apparent winners of the digital ad economy—Facebook and YouTube—must operate at vast scale, engage in copious surveillance, and subject their systems to minimal human oversight to make ad financing work.”

Wired

But there is an appetite for a different way, as evidenced by the staggering growth of Patreon, a modern day crowd-sourced patronage service. It seems reasonable to assume that there are even more people who would like to make small payments to their favourite content creators without having to go through the hassle of creating an account, coming up with a password that is both memorable and difficult to crack, handing over payment card details, and making a decision to support a creator into the future as well as today. Not to mention the inevitable but irritating follow-up emails.

So why is there no micropayment standard for the open web?

The history of micropayments

The need for a web-native payments protocol has been recognised for almost as long as the web has been in widespread use. The error code 402 Payment Required was included in the 1997 HTTP protocol specification, albeit as ‘reserved for future use’ as it remains today. It was only in 2015 that the W3C (the web standards consortium) started working on web payment standards. But even those standards are primarily aimed at discrete payments, such as a one-off payment in an ecommerce paradigm.

So twenty years after the error code was created, the web remains without a protocol for payments that is truly native, and reflects most users’ experience of the web:

- Decentralised – anyone can contribute without having an account with a centralised body

- Frictionless – there is very little cognitive load required to access information

- Continuous – a user can make a single HTTP request or retrieve a huge file

It’s not for lack of interest or effort. Indeed there is a long list of attempts to deliver digital payments that are at least frictionless and continuous from players as varied as enterprises like Microsoft, British Telecom (BT), IBM and Compaq; through to start-ups like BitPass, DigiCash, Internet Dollar and Beenz.

But payments and money are inextricably linked with identity, data and privacy, matters which underpin modern civilisation. So it should be unsurprising that innovation in this space involves tackling many difficult challenges.

There are some fascinating examples of where virtual currencies have been available within the closed ecosystems of games or virtual worlds. One of the mass experiments in virtual worlds is Second Life which includes its own virtual currency: the Linden Dollar (L$). In 2009, the total size of the Second Life economy grew 65% to US$567 million, about 25% of the entire U.S. virtual goods market and faced challenges such as centralised control by Linden Labs (the de facto totalitarian government). Linden Labs needed to create monetary policy and foreign exchange and taxation regulation compliance because there are on and off-ramps (for example via an exchange) that allow users to buy and sell L$ for USD or other fiat currencies.

Other examples come from the world of gaming, with a couple of great examples. Eve Online is a space-based, persistent world massively multiplayer online role-playing game (MMORPG). The virtual currency is Interstellar Kredits (ISK). In comparison to Linden Dollars and the Second Life financial system, the Eve Online economy is an ‘open economy’ that is largely driven by players trading materials, services and manufactured goods such as equipment and ships. There is no off-ramp from ISK to fiat currencies but as an open economy, many real-world behaviours such as market manipulation, scams and even ‘crimes’ are faithfully reproduced in this closed, virtual world.

Perhaps the clearest illustration of the difficulties is Microsoft’s Passport project. Passport sought to provide a unified online account for web users, very much comparable to the Facebook Connect ‘Login with Facebook’ functionality now widespread. Microsoft Passport was just gaining traction in 1999, just as the antitrust proceedings were getting underway, with a number of sites committed either to using Microsoft Passport for login, or for ecommerce payments. From there, it would have been a small step indeed to enable micropayments through the same system. But the antitrust case (in which the US government successfully argued that Microsoft was illegally enforcing its monopoly) that forced Microsoft to abandon the project.

So what’s changed?

If this idea has been around for so long, and the opportunities seem so clear, what factors have blocked progress so far and in what ways have those factors changed such that we might believe that the age of micropayments is finally upon us?

Decentralised technologies

The raw technical ability for micropayments to happen has existed for a long time, but examples like Microsoft Passport would have relied on a centralised 3rd party (in this case Microsoft) holding the ledger and wallets. This has historically proved too provocative for governments to accept, and would further restrict the use of these micropayments to people that had accounts with those centralised provider(s).

The technological change that matters here is Bitcoin and cryptocurrency. After ten years, Bitcoin has more or less proved that secure, decentralised ‘hard money’ is technologically and practically possible. From the breakthrough success of Bitcoin has come an entire constellation of related digital money technologies and efforts. This has both re-invigorated interest in micropayments (indeed value exchanges of all sorts) and provided a way that organisations wishing to leverage micropayments can work around issues of centralised organisations and accounts.

Familiarity and habituation

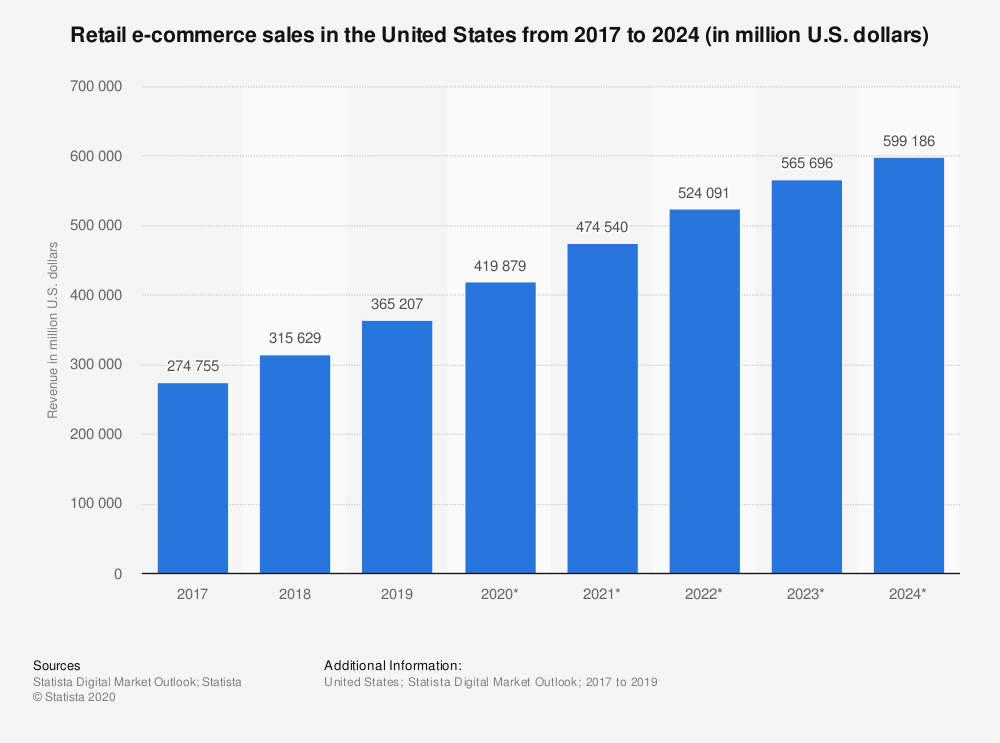

For many web users, using digital wallets and currencies to make micropayments for non-fungible digital assets is now second nature. The growth of ecommerce in general has been notable over the last 10 years but it’s really the growth of ‘in-app’ purchases that are key to the acceptability of micropayments.

Retail e-commerce sales in the United States from 2017 to 2023 (in million U.S. dollars)

For many folks, micropayments will be as simple an experience as buying a new book through their Kindle e-reader. But to see this digital economy in real action we must look to the world of online gaming where millions of children are currently earning, buying, selling, trading new levels, skills and features such as custom skins for their online characters. Some in-game currencies are worth more than those of entire nations – for example World of Warcraft’s currency seems to be a far better investment than the Venezuelan Bolivar.

Adoption critical mass

For micropayments (as many other technologies) there exists a critical mass problem, whereby if there are either not enough creators accepting micropayments or visitors ready to give micropayments, the entire enterprise falls down. Businesses like Patreon have now proved that it’s possible to find enough creators and visitors willing to embark on this kind of relationship that seemingly all that remains is to find a vehicle through which to connect both sides of the marketplace at scale using a web-native experience.

With the world’s biggest digital platforms counting their active users in the billions, it certainly seems that a potential critical mass exists.

But how to encourage people to put money in their micropayment wallets? The obvious way to get funds into a wallet would be simply to pay that money in from somewhere else – like one topping up a debit card for use abroad. But there are other ways too:

- Trading – selling in-game points for example. This modality is well-proven through online gaming where it is common for users to buy and sell in-game assets using in-game currency they’ve earned through gameplay.

- Earning – projects like Brave point the way for how people could earn (as well as spend) micropayments. Brave is a privacy-centric browser that includes a token-based micropayment system that rewards people for watching ads, or allows them to skip ads and instead pay for the content. With a groundswell of awareness of the mass collection and monetisation of personal data, allowing consumers to earn by sharing their data creates a more equal and therefore perhaps more sustainable model for advertising.

Dawn of corporate money

The highly controversial Libra project (led initially by Facebook) seems to be treading many of the same boards as the Microsoft Passport project. It’s notable that Facebook Connect is already ubiquitous; seemingly flying in the face of Microsoft Passport’s failure. The launch of Facebook Pay seems directly parallel to Microsoft’s earlier efforts to build a wallet into Passport.

However, Facebook also seems to have learned lessons from the antitrust case and has been careful to set clear air gaps between itself and Libra. The Libra Association is not part of Facebook. It’s a standalone non-profit, headquartered in Switzerland and backed by a consortium of diverse organisations.

By decoupling the Libra cryptocurrency from Facebook’s identity service in this way, it’s possible that Facebook will be able to bypass current legislation and keep a step ahead of government attempts to assign them the same fate as Microsoft.

Whatever the specific implementation, and in which countries it happens first, it seems that there’s no putting the genie back in the bottle when it comes to corporate money now.

What’s the downside?

Users don’t always appreciate being made to pay

Microtransactions already underpin the economics of the gaming world. A market study conducted by online financial marketplace LendEDU last year revealed that almost seven in 10 of gamers who spend between six and 10 hours playing a game of their choice use micropayments with each individual, on average, spending more than $84 in the game.

These micropayments are used to purchase additional features within the game. These features are generally optional, but the willingness of gamers to buy them creates a significant ongoing revenue stream for the publisher of the game and had led to a situation where free-to-play games generate more revenue than their paid-for counterparts.

But it is important to note that the reaction to this new gaming paradigm is contentious to say the least; both from players who feel squeezed for money at every turn, and regulators concerned that the gaming economy is becoming a bit of a financial Wild West.

Perhaps a more insidious danger is that the line between monetised gaming and gamified gambling is a thin one that even reasonably sophisticated gamers may struggle to recognise, let alone the 20+% of gamers who are under 18. Adding micropayments to an already complex digital space does not bring only benefits, it will bring significant challenges too.

Customer preferences and business model disruption

If you’re a publisher that’s created a successful business of asking people to pay a monthly recurring fee, micropayments are potentially a disruptor. If micropayments become commonplace, how will this affect your subscription business? It opens up a lot of questions.

Will a proportion of your current subscribers want to switch to a pay-per-view micropayment model? If so, will you enable that option? What technological changes would you need to integrate into your paywall solution? What should be the cost for accessing a single article or content piece? Does that undermine or complement your subscription offering? Are there different benefits or packages that could or should be available to micropayers rather than subscribers? What additional intelligence can you derive about your value proposition from this diversification? Does messaging about micropayments, if any is needed, complicate and confuse your marketing and conversion journeys?

A key issue for content publishers is to determine whether consumers prefer per-use or recurring payment options. The broader trend in digital is from individual transaction to recurring subscription. Beyond that we head towards individually-tailored experiences and dynamic pricing. Micropayments give content creators another revenue opportunity in their toolkit, ready to apply to users who prefer them.

A survey of more than 5,000 US consumers published by McKinsey in 2018 found that 15% of online shoppers had signed up for one or more subscriptions and 46% had subscribed to an online streaming media service.

The median number of subscriptions an active subscriber held was two, but more than one third had three or more. However, McKinsey noted that consumers do not have an inherent love of subscriptions and if anything, the requirement to sign up for a recurring subscription dampened demand and made it harder to acquire customers.

Rather, they want a great end-to-end experience and are willing to subscribe only where automated purchasing gives them tangible benefits, such as lower costs or increased personalisation. To continue subscribing, consumers expect personalised subscriptions to become more tailored over time.

It’s still an emerging trend

As ever with emerging technologies, there’s a careful balance to be struck between moving quickly and potentially gaining an edge over your competition, and waiting until the lessons have been learned by other players before moving on your own strategy.

What micropayment options are available right now?

There is a surprising number of currently-available options for receiving small payments. They can broadly be divided into two categories: payment services, and platforms.

Payment services, defined as micropayment-capable services that can be integrated into a wide range of websites, apps and digital services. Here are some examples (please don’t take any of these as endorsements!):

- Axate – a federated digital wallet

- PayPal MicroPayments – slightly reduced fees for smaller payment amounts

- Coil – which we discuss further below – a pre-paid micropayments service that integrates with your browser and websites through open standards

- tippin.me – promotes adoption of Lightning Network, a technology built on top of Bitcoin that allows users to send and receive any amount of Bitcoin within seconds)

- Patreon – a crowdfunding membership platform that provides business tools for creators to run a subscription content service where artists build relationships and provide exclusive experiences to their subscribers

- Flattr – uses a smart algorithm to measure attention and distribute subscriptions

- Mixer – Microsoft’s game stream service where viewers passively accrue a currency called Sparks that goes back to the streamer in the firm of a preset amount of money

- Brave Rewards – where the user’s browser automatically starts tallying – on the device’s local storage – the attention they spend on sites they visit and send the corresponding amount of a token once a month from the local browser-based wallet to the sites visited

- Jamatto – a micropayments service with solutions aimed at a wide range of digital publishers

- M-coin – a mobile carrier-based payment service

- Zlick – a payment solution that uses mobile carriers to combine single article sales with subscription models

- Likecoin – a cryptocurrency-based micropayment project

- Fortumo – another mobile carrier-based solution

- Satoshipay – allows content creators to charge users per article, download, second of video, temporary website access or simply ask for a donation

- Laterpay – which does the cost aggregation in reverse – i.e. let’s a visitor accrue micropayments up to a certain ‘tab value’ before it’s settled.

- Unlock protocol – there is a WordPress plug-in, a protocol for memberships which lets any creator monetise their content in a permissionless way. In order to become a member, visitors need to be using a web3 enabled wallet such as MetaMask or a web browser with an embedded wallet, such as Opera. They also need a balance of Ether in order to purchase keys to pay for the memberships, which can be bought on exchanges such as Coinbase.

- Browser/application wallets – an enabling technology that allows browsers to be able to store and transfer value; enabling either payment services or platform services.

Platforms – here broadly defined as destinations where the micropayments are broadly tied to the visitors being on particular websites or digital properties:

- Blendle – an online news platform that aggregates articles from a variety of newspapers and magazines and sells them on a pay-per-article basis

- Scroll – carries ad-free versions of news sites and claims to pay publishers more than advertising

- Medium – an online publishing platform founded by a former co-founder and CEO of Twitter, who originally envisaged it as a way of publishing content longer than Twitter’s maximum

- Substack – this concept applied to newsletters

- Civil – a decentralised platform for independent publishers, bound by a constitution that incorporates extensive use of tokens

- Newspack from WordPress.com – a publisher-focussed platform that also integrates Civil

- Ghost 3 – a CMS that has subscriptions bundled into its hosted service

Coil is finding a way to credit the creators – a glimpse of the future

Imgur is offering a glimpse of the future creator economy where content creators get paid in microtransactions by the people who are enjoying their content. The meme and storytelling app has received an investment from Coil (mentioned above), a micropayment service for creators, that Imgur has agreed to build into its service.

Users will pay Coil a fixed monthly fee and install its browser extension which acts as a browser-based digital wallet. This browser extension then looks for a meta tag in the website header that complies with the Web Monetization draft W3 standard. When it finds it on a web page, it uses the Interledger protocol to stream money in analogy to the way that Netflix streams video.

By having the Coil browser add-on or third party wallet, the user’s browser will compensate content creators automatically and directly – paying funds directly to a digital wallet owned by the website owner (or indeed any wallet – perhaps that of an individual guest contributor or a charity).

By leveraging open protocols and standards, Coil are showing how it’s possible to bring micropayments to the open web. Indeed, a website employing the Web Monetization standard can now receive funds from any WM-capable browser-based digital wallet. Coil is the main one for now, but there’s every opportunity for competition and open innovation; one of the main reasons why their approach feels more compelling than many.

Creating a successful microtransactions strategy

Types of micropayment strategy

- Pay as you go – kind of the dream / gold standard

- Prepay – pay up front, spend. This is how Coil, Patreon, and others work

- Post-pay – Laterpay for example

- Aggregation – Blendle for example

- Paymium – paid but also add on micropayments for incremental value unlocking

Use cases for micropayments

- Content – premium content, alternative to ads

- Marketing and engagement – pay users to watch ads, otherwise incentivise loyalty and engagement

- Email or other messaging – prevent spam or access services, enable access to premium bots

- Games – features, characters, levels

- Charity – donations

- Software / SaaS – pay per use eg microservices, APIs, serverless technologies

- In future – XR – augmented/virtual/mixed reality

Considerations for micropayment strategies

Standalone payment services have a number of drawbacks. They need to be implemented on the website, which leaves content creators and publishers facing the marketplace paradox: no one will implement it if no one is using it, but no one will use it if no one is implementing it, which can leave publishers in a ‘chicken and egg’ situation.

There are also issues with platforms. Firstly, you need to abide by their terms, which they can change at any time, as has been the case with Etsy and Medium, and once the platform reaches a certain scale they often start to squeeze content creators. Secondly, platform users lack creative control and multichannel support.

A further challenge is identifying a niche where there are enough potential subscribers and platform users and determining whether that is on a platform or on your own site using standalone tools.

Finding the balance between discoverability and revenue is a core challenge for creators, as are user expectations that content will be free.

Technically, enabling micropayments and starting to collect data via analytics might require an extension to your analytics data layer, reporting and business intelligence tooling.

It will also be necessary to test micropayments against subscription payments to understand what an effective strategy will be. This will depend on whether the core audience always wants to pay monthly but occasional visitors prefer to pay per-use.

Ultimately Angry Creative believes that micropayments are simply another requirement to add to the extremely long list of other website requirements. Your ability to implement micropayments may well depend on the agility of your owned online estate – if it’s possible at all, is it cost-effective to make the changes you need? Angry Creative’s philosophy is, of course, that using Free and Open Source Software warranties you against the risk that you will be unable to implement any particular requirement at all. Further, we believe that using WordPress gives you the best possible chance of being able to do so in a cost-effective way.

Why build your micropayment strategy around WordPress?

There are several reasons why WordPress is particularly suited to being at the heart of a content monetisation platform:

- You can integrate almost any payment service already, often simply by installing a plugin and no-code configuration

- If you need to migrate away from a restrictive platform, there are a ton of tools and service providers available to help you achieve this on a cost-effective basis.

- Iterating a WordPress-based site is pretty much as low cost as it’s possible to achieve. This builds confidence in an experiment, learn, iterate strategy that’s well-suited to emerging trends and technologies like micropayments

- It provides the option to integrate micropayments with other content marketing and monetisation strategies – allowing you to control and blend your approach to find out which works best for your organisation

- WordPress is such a significant part of the web that anyone looking to implement micropayments as a service is going to be investing in making it work for WordPress pretty early on

This latter point is evidenced by our recent work with Coil to create a WordPress plugin that allows website owners to implement web monetisation quickly and easily. Moreover, it leverages WordPress’ Gutenberg editor to allow editors to show/hide different content blocks (a house ad or a piece of analytical text for example) based on a user’s web monetisation status.

This can be used to help surprise and delight visitors, as well as being a useful segmentation data point. For example, if you already run a website with a members’ area, or other tiered content access, then a nice experiment to test would be:

“For web-monetised non-members, we think that providing a little extra access to gated content will help drive engagement and ultimately increase membership enquiries.”

This kind of experiment would be easy to implement in WordPress with a membership plugin alongside the Coil plugin.

In conclusion

In this white paper, we’ve discussed the reasons why micropayments have been largely absent from the web, why that matters and how they can solve some of the challenges faced by publishers and creators. By looking at the trends that support the growth of demand for micropayments, and taking a look at some of the current services and platforms, we’ve shown that the time to take micropayments seriously is now.

We think this technology, when implemented through open protocols and standards, is both a necessary change to enable the next generation of digital media, and an opportunity to fix some of the problems with today’s web.

You may also be interested in these articles

Brexit for WooCommerce sellers

The impact of Brexit is huge. There are very many implications for those in e-commerce businesses…

Read more

Brexit for WooCommerce sellers

Cynefin: a valuable framework to classify, communicate and respond to tasks in digital projects

Cynefin. At Angry Creative we think it’s a vital part of digital projects. It helps us to underst…

Read more

Cynefin: a valuable framework to classify, communicate and respond to tasks in digital projects

Web fonts for WordPress

Fonts control how your text is displayed – how the letters actually look. web-safe fonts. W…

Read more

Web fonts for WordPress

Subscribe to our newsletter for tips, inspiration and insight about WordPress and WooCommerce and the digital world beyond.

Time to take the next step towards a more effective website?

Contact us, and we can talk more about how we can take your business to the next level together.